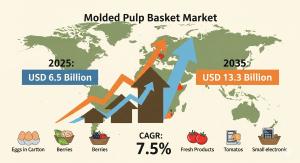

Molded Pulp Basket Market to Reach USD 13.3 billion by 2035 as Sustainability Drives Packaging Innovation

The molded pulp basket market will grow from USD 6.5 billion in 2025 to USD 13.3 billion by 2035, led by eco-packaging demand and new technology innovations.

NEWARK, DE, UNITED STATES, September 3, 2025 /EINPresswire.com/ -- The molded pulp basket market is on the cusp of a significant transformation, driven by a growing global commitment to sustainability and innovation in packaging. Valued at USD 6.5 billion in 2025, the market is projected to reach USD 13.3 billion by 2035, expanding at a compound annual growth rate (CAGR) of 7.5%.

This rapid growth reflects shifting consumer expectations, tighter environmental regulations, and the packaging industry’s collective drive to provide cost-effective, biodegradable, and high-performing alternatives to plastic.

A Packaging Revolution Backed by Sustainability

Molded pulp baskets, made from recycled wood and non-wood fibers, are gaining traction as the go-to solution for eco-friendly packaging. They are biodegradable, recyclable, durable, and cost-efficient—qualities that make them a strong rival to plastic-based packaging. Their versatility has allowed them to expand from egg cartons and produce trays to applications in food and beverage, cosmetics, logistics, and even household decoration.

Governments worldwide are tightening restrictions on single-use plastics while advancing circular economy models. Retailers and producers are responding with pledges to reduce plastic across their supply chains. In this context, molded pulp baskets are no longer a niche solution—they are becoming a mainstream packaging choice.

Request Molded Pulp Basket Market Draft Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-7222

Innovation at the Core of Market Expansion

Manufacturers are reimagining how molded pulp baskets are produced. Advances in molding equipment, surface finishing, and raw material sourcing are improving product durability, precision, and scalability. These innovations are helping molded pulp packaging gain wider acceptance in industries that require strength, structural integrity, and automated compatibility.

Established players like Henry Molded Products Inc., UFP Technologies, Pactiv LLC, OrCon Industries, and Huhtamaki Oyj are investing heavily in R&D, scaling production capacity, and introducing new basket designs that combine sustainability with strength. Meanwhile, emerging firms such as Pacific Pulp Molding, FibreCel Packaging, and Guangxi Qiaowang Pulp Packing Products Co. Ltd. are bringing agility, affordability, and localized expertise, carving niches in high-growth regions across Asia-Pacific and Latin America.

Together, these companies—both giants and newcomers—are reshaping the competitive landscape by focusing on precision molding, water recycling systems, and compatibility with renewable raw materials.

Segmental Insights: Thick Wall, Wood Pulp, and Carrying Trays Lead the Way

By type, thick wall molded pulp will command the largest share at 30.2% of market revenue in 2025. Favored for its thermal insulation, shock resistance, and durability, thick wall pulp is widely used in produce handling and industrial packaging. Its dense structure, created through longer pressing cycles and lower drying temperatures, provides the strength needed for transporting delicate or heavy items across extended supply chains.

By pulp source, wood pulp will lead with 34.6% of revenue in 2025. The global availability of softwood and hardwood fibers, coupled with their strong bonding properties and cost efficiency, makes wood pulp the most reliable input material. Certification standards such as FSC and PEFC are also enabling manufacturers to align with sustainable sourcing practices, ensuring both compliance and credibility with eco-conscious consumers.

By application, carrying trays will dominate with 33.7% of revenue in 2025. Trays for fresh produce, eggs, beverages, and confectionery are becoming the backbone of logistics and retail-ready packaging. Their light weight, recyclability, and customizability make them the preferred alternative to plastic crates. From partitioned trays for bottles to reinforced trays for heavier loads, molded pulp is meeting the diverse needs of food distribution networks.

Regional Dynamics: North America, Asia-Pacific, and Europe Lead Growth

In North America, rising consumer awareness and regulatory pushes are driving rapid adoption of molded pulp packaging. The U.S. in particular remains a hub for both established giants like Pactiv and innovators like EnviroPAK Corporation, which are pushing recyclable and compostable solutions deeper into the food and beverage sector.

Asia-Pacific, led by China and India, is projected to become one of the fastest-growing regions. High agricultural output, expanding middle-class consumption, and increasing governmental focus on reducing plastic dependency are spurring adoption. Local firms such as Guangxi Qiaowang Pulp Packing Products are capturing this momentum by scaling low-cost, high-volume solutions.

Europe is also central to market expansion, as EU-wide plastic bans accelerate the shift to sustainable packaging. Companies like Celluloses De La Loire and Keiding Inc. are capitalizing on the region’s strong regulatory support for eco-packaging innovation.

Dynamics Shaping the Future of Molded Pulp Baskets

The global molded pulp basket market is being shaped by powerful macroeconomic and industry trends. Urbanization, rising e-commerce, and shifting consumer lifestyles are creating a demand for standardized, lightweight, and recyclable packaging formats. At the same time, the food and beverage industry’s pivot toward sustainable branding is positioning molded pulp as a natural fit for fresh produce, bakery goods, and beverages.

Technological advancements are enabling molded pulp to compete with plastics not only in sustainability but also in performance. With designs becoming more sturdy and precise, molded pulp baskets can now withstand long-distance logistics without compromising product safety. Closed-loop water recycling systems and renewable pulp inputs are making manufacturing processes more efficient, reducing environmental footprints while cutting costs.

For more on their methodology and market coverage, visit! https://www.futuremarketinsights.com/about-us

Competition and Collaboration

The molded pulp basket market is highly competitive, with global leaders and local firms working to strengthen their foothold. Companies like Huhtamaki Oyj and Pactiv LLC are doubling down on technology-driven solutions, while EnviroPAK, ProtoPak Engineering Corporation, and FibreCel Packaging are leveraging customization and quick adaptability to meet niche demands.

Meanwhile, acquisitions and partnerships are becoming a strategic avenue for growth. Larger corporations are increasingly acquiring smaller, innovative players to expand their portfolios and align with consumer and regulatory sustainability demands. This blend of consolidation and competition is fostering a healthy, innovation-driven marketplace.

Related Reports:

Cork Packaging Market: https://www.futuremarketinsights.com/reports/cork-packaging-market

Metal Decal Market: https://www.futuremarketinsights.com/reports/metal-decal-market

Bulk Bag Dischargers Market: https://www.futuremarketinsights.com/reports/bulk-bag-dischargers-market

Editor’s Note:

This release is based exclusively on verified and factual market content derived from industry analysis by Future Market Insights. No AI-generated statistics or speculative data have been introduced. This press release highlights significant shifts in the Molded Pulp Basket Market, which is experiencing a pivotal change driven by consumer demand for healthier, more transparent products.

Rahul Singh

Future Market Insights Inc.

+18455795705 ext.

email us here

Visit us on social media:

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.