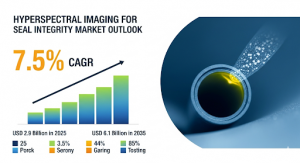

Hyperspectral Imaging for Seal Integrity Market to Reach USD 6.1 billion by 2035 with AI and Sustainability Advancements

The hyperspectral imaging for seal integrity market will reach USD 6.1 billion by 2035, doubling in size as AI, sustainability, and new entrants reshape growth.

NEWARK, DE, UNITED STATES, September 4, 2025 /EINPresswire.com/ -- The hyperspectral imaging (HSI) for seal integrity market is entering a decade of rapid transformation. Valued at USD 2.9 billion in 2025, the market is projected to expand to USD 6.1 billion by 2035, more than doubling in size with a robust 7.5% CAGR. This remarkable growth of USD 3.1 billion underscores the rising importance of high-precision, non-destructive inspection systems in packaging for food, pharmaceuticals, and sterile medical devices.

A Market in Two Phases

Between 2025 and 2030, the market is expected to gain USD 1.1 billion, supported by the food & beverage and pharmaceutical sectors. During this period, short-wave infrared (SWIR) systems dominate as manufacturers demand fine-tuned, real-time defect detection for modified atmosphere packaging (MAP). By 2030 to 2035, growth accelerates further, adding USD 2.0 billion. This phase is characterized by AI-powered inspection platforms, edge-processing modules, and sustainability-driven solutions that can validate seals in recyclable and bio-based materials.

Request Hyperspectral Imaging for Seal Integrity Market Draft Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-23033

Why Hyperspectral Imaging Matters

HSI enables manufacturers to spot invisible or subsurface defects—leaks, wrinkles, contamination, or delamination—without damaging the product. Unlike conventional cameras, hyperspectral systems capture hundreds of spectral bands, delivering pixel-level chemical and structural insights. In industries where consumer trust, regulatory compliance, and product integrity are paramount, HSI is emerging as an indispensable quality assurance tool.

From ready-to-eat meals and baby food to sterile medical devices and pharma blister packs, HSI supports compliance with regulations such as FSMA, GMP, FDA CFR 21, EU MDR, and ISO 11607. Its non-destructive, high-speed inspection reduces recalls, ensures safety, and minimizes packaging waste.

Segmental Insights

- Spectrum: The near-infrared (NIR) segment leads with 46.1% share in 2025, valued for its deep penetration into packaging films and precise detection of micro-defects.

- System Type: Inline conveyor-based systems dominate at 51.2% share, reflecting growing integration into high-speed automated lines.

- Application: Seal defect detection remains the primary use case with 43.2% share, ensuring packaging integrity across diverse formats.

- End Use: The food & beverage sector commands a 51.5% share, driven by FSMA compliance and consumer demand for transparency and freshness.

Regional Growth

The market’s geographic expansion reflects diverse regulatory and industrial landscapes:

- United States: Fastest-growing at 8.4% CAGR, supported by FDA regulations and adoption in pharma and medical device packaging.

- United Kingdom: Expanding at 7.2% CAGR, where startups and automation integrators are bringing compact, AI-driven HSI modules to SMEs.

- India: Matching 7.2% CAGR, with pharma exports and WHO-GMP standards fueling adoption in blister and strip packaging.

- China: Growing at 6.4% CAGR, backed by domestic food safety campaigns and AI-enhanced inspection across pouch and tray lines.

- Germany: Advancing at 6.3% CAGR, integrating HSI into cleanroom packaging and traceability automation.

- Japan: Rising at 8.1% CAGR, driven by robotics-integrated packaging and stringent hygiene standards.

- South Korea: Expanding at 6.4% CAGR, particularly in K-food exports, OTC pharma, and diagnostic kits.

Drivers and Barriers

Growth drivers include increasing safety regulations, sustainability mandates, and the shift toward automated, AI-enabled inspection. However, barriers such as high upfront costs, calibration complexity, and the need for skilled operators continue to challenge adoption, particularly among SMEs.

The solution lies in AI-driven defect classification and modular inline integration, which reduce false positives and make HSI more accessible. The convergence of hyperspectral cameras with machine learning, cloud dashboards, and remote diagnostics is making advanced inspection both scalable and cost-efficient.

Established Leaders and New Entrants

The competitive landscape is evolving from hardware-centric dominance to intelligent inspection ecosystems.

Established leaders such as Specim, Headwall Group, and Engilico are advancing hyperspectral cameras with enhanced spectral precision, AI-enabled defect recognition, and inline compatibility. Their focus is on delivering non-destructive inspection at scale, with systems optimized for pouches, thermoformed trays, and blister packs.

Mid-sized innovators like Cubert GmbH and Middleton Spectral Visualization (MSV) are tailoring solutions for inline and offline deployments, making HSI accessible to mid-tier manufacturers. Their emphasis on spectral calibration and user-friendly software is helping expand adoption in ready-to-eat meals, sterile packaging, and high-value pharmaceuticals.

Meanwhile, new entrants and startups are challenging incumbents by offering open-architecture systems, cloud-integrated dashboards, and sustainability-linked rejection algorithms. These solutions appeal to medium-sized enterprises aiming to comply with regulations while managing costs and scaling digital transformation.

For more on their methodology and market coverage, visit! https://www.futuremarketinsights.com/about-us

Shifting Revenue Models

From 2020–2024, hardware systems made up nearly 70% of market revenues, with software and services contributing less than 10%. By 2035, the picture changes dramatically: AI analytics, subscription-based software, and remote diagnostics are projected to capture over 40% of revenues.

This shift signals a move away from hardware precision alone toward data-driven ecosystems, predictive maintenance, and recurring revenue models. Manufacturers that adapt to this transition—offering not only advanced cameras but also workflow scalability and intelligent inspection platforms—are likely to maintain leadership.

Recent Developments

- 2025: Engilico launched its HyperScope® in-machine seal inspection system at IFFA 2025, underscoring its focus on inline automation.

- 2024: Specim was named Photonics Finland Company of the Year for its contributions to the photonics industry and hyperspectral innovation.

These developments highlight how established companies are pushing technological boundaries, while leaving space for smaller innovators to gain traction with niche, sustainable, and modular solutions.

Related Reports:

Steel Drums & IBCs Market: https://www.futuremarketinsights.com/reports/steel-drums-and-ibcs-market

Rigid Industrial Packaging Market: https://www.futuremarketinsights.com/reports/rigid-industrial-packaging-market

Polypropylene Packaging Films Market: https://www.futuremarketinsights.com/reports/polypropylene-packaging-films-market

Editor’s Note:

This release is based exclusively on verified and factual market content derived from industry analysis by Future Market Insights. No AI-generated statistics or speculative data have been introduced. This press release highlights significant shifts in the Hyperspectral Imaging for Seal Integrity Market, which is experiencing a pivotal change driven by consumer demand for healthier, more transparent products.

Rahul Singh

Future Market Insights Inc.

+18455795705 ext.

email us here

Visit us on social media:

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.